S T E P S T O T A K E

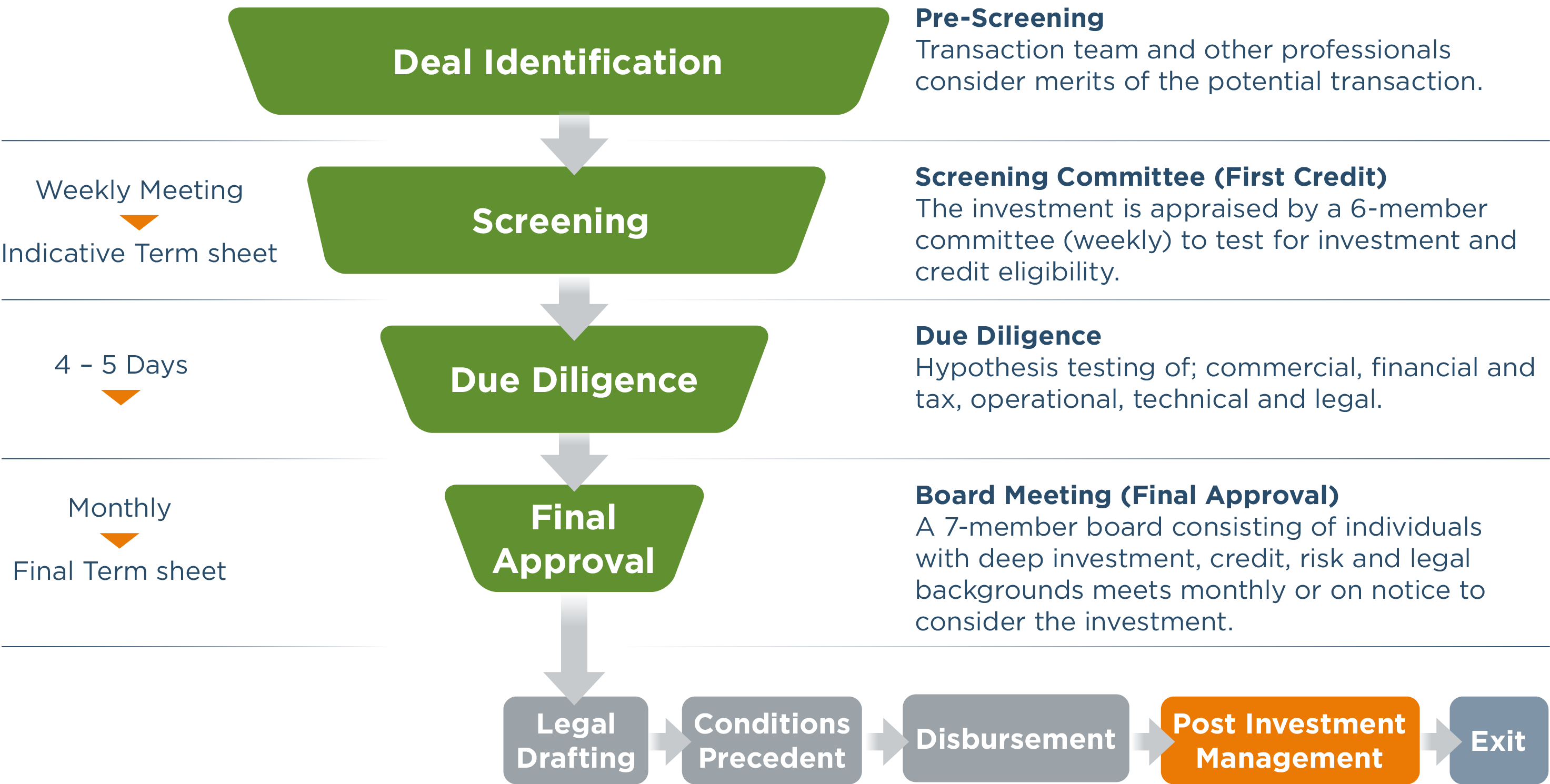

Investment Process

We follow a rigorous, credit-centric and disciplined investment process in identifying target partners, which helps us achieve our purpose of building a better Africa.

We use both top-down and bottom-up approaches to develop an investment thesis and test investment hypotheses in evaluating investments. The principal thesis shall be around achieving the envisaged financial performance, as well as delivering the envisioned impact.

Steps in the investment assessment process

1. Application

Pipeline sourcing and direct application of proposals in line with our criteria - what we look for (use the online platform provided on this website to apply or get in touch with us).

2. Deal Identification

Our transaction team and other professionals review and consider the merits of the potential transaction.

3. Credit Committee

The investment is appraised by a six-member committee (weekly) to test for investment and credit eligibility.

4. Due Diligence

This involves an on-site hypothesis testing of commercial, financial and tax, operational, technical and legal aspects of the investment.

5. Final Approval

A seven-member board consisting of members with deep investment, credit, risk and legal backgrounds meets monthly or on notice to consider the investment.