L O N G - T E R M P A R T N E R S

What We Do

We provide direct debt financing of between USD5 million and USD15 million to mid-market companies for growth and development.

We are a long-term funding partner with a typical investment holding period of 4 to 7 years. We work with sponsors, entrepreneurs and management teams to provide tailor-made financing solutions that enable their companies to achieve their strategic goals.

We can implement fast, flexible and reliable debt-based funding for companies over the complete lifecycle of an investment. This includes funding for businesses seeking growth capital or looking to scale through acquisitions.

Instruments

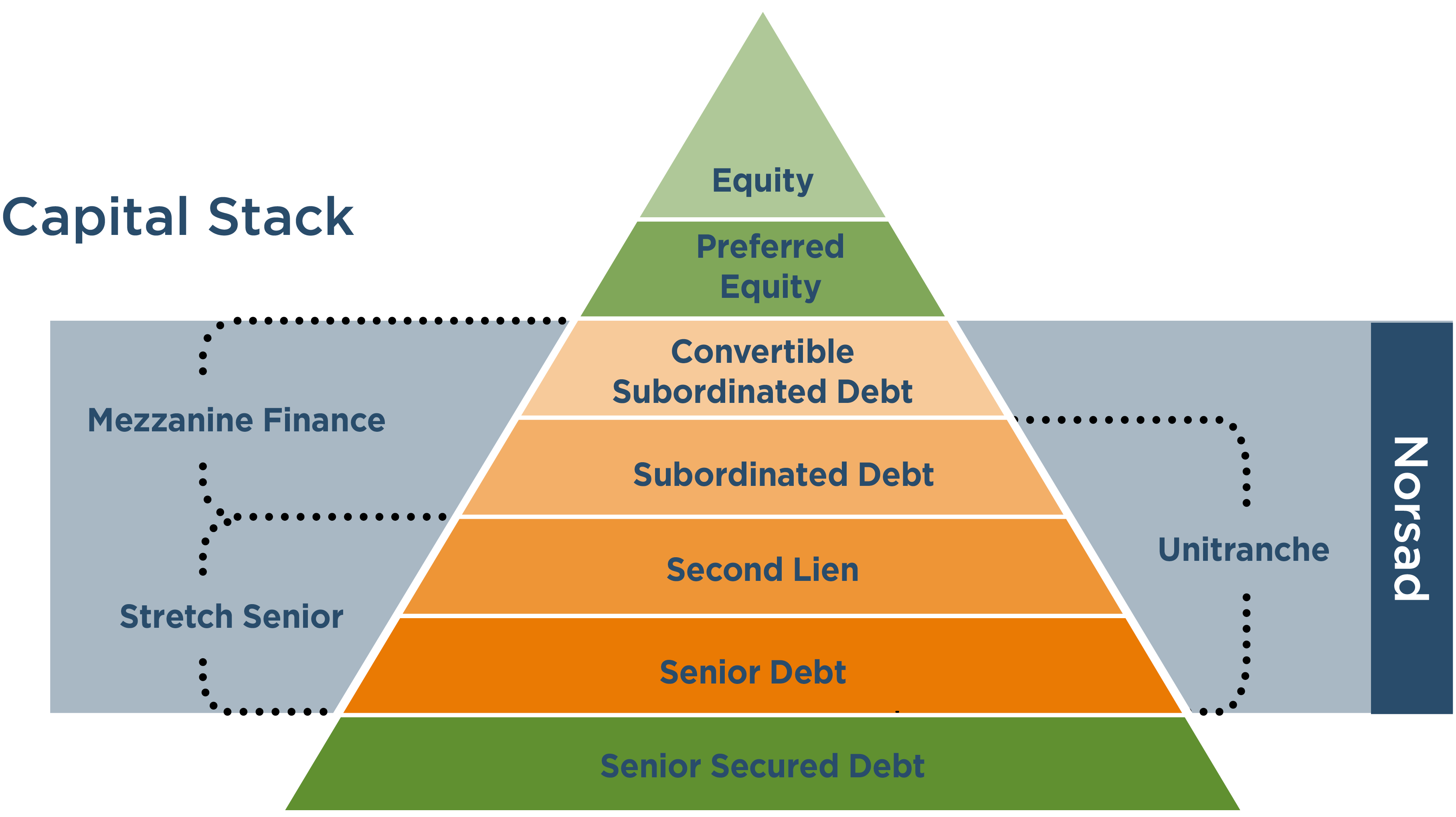

We offer a range of debt products in the middle of the capital stack, including senior debt, stretch senior, unitranche, second lien and mezzanine finance. We customise financing solutions to each individual client, depending on their business needs and capital structure.

Here are some definitions for the types of finance we offer:

What is senior debt finance?

Senior debt is a company's highest priority debt that must be repaid first during bankruptcy.

These are typically secured by a lien against some type of collateral although they can also be unsecured. In the event of bankruptcy or if the loan goes into default, the collateral of a secured senior debt facility may be sold to cover the debt. Unsecured senior debt holders can file claims against the company’s general assets.

What is second lien finance?

Second lien debt is secured debt that ranks equally for payment with senior debt and shares the same security package. Second lien loans are not debt subordinated to first lien loans, only on the capital pledged to secure the loan. This means that in the event of bankruptcy, second lien ranks behind senior debt in the receipt of proceeds from shared collateral.

What is unitranche finance?

Unitranche finance combines senior and subordinate debts into one loan, so that the institutional borrower pays a blended interest rate and has a predictable repayment schedule that can be tailored to the borrower’s needs. Unitranche financing can enable medium-sized companies to access financing that would be impossible to get from a bank.

What is mezzanine finance?

Mezzanine finance is a hybrid form of funding that combines features of debt and equity. They are senior to equity and subordinated to senior debt in the capital structure. Mezzanine finance can also be utilized in acquisitions and buyouts or to minimise dilution of equity. Companies will usually consider mezzanine financing to finance business goals when they have maximized senior debt borrowing capacity or seek to preserve future senior debt capacity.

MORE ABOUT

Private Credit

[TABS_PRO id=6974]