Recognising their common goals, the Development Bank of Angola (BDA) has joined forces with Norsad Capital, a provider of private credit to businesses in a growth stage. This partnership will be formalized at a ceremonial event at the Hotel Palmeiras, in Talatona – Luanda, at 11 am on June 29, 2023. The Parties will sign a Memorandum of Understanding which will set out the terms of the partnership.

According to Kenny Nwosu, CEO of Norsad Capital, “in essence, our agreement means that we will introduce each other to potential transactions so that we can maximise the deal flows. We each have our own expertise and funding models so, together, we can provide far more in-depth insights when putting together a deal.” Both financial institutions focus on providing much-needed capital to businesses, which can be used to promote economic growth and improve the lives of people on the continent of Africa. “We recognise that we share common objectives in terms of private sector development in Angola, and this is what drives our decision to collaborate with each other,” explains Patrícia de Almeida, CEO of the BDA.

As a public financial institution, the BDA’s major focus is promoting ongoing economic growth through sustainable development in the country, which includes raising the country’s competitiveness on the world stage. Its initiatives promote the well-being of the Angolan population by granting credit to the economy, boosting the business sector, creating jobs and increasing sustainable livelihood opportunities.

In terms of the agreement, the two Parties will share contacts for potential business; assist each other when putting together sizable deals; and share an investment opportunity should the amount required exceed the limits available for funding by each party.

A particularly important element of the co-operation is that the Parties will support each other in working to further promote the private sector’s role in growing the economy. “The government of Angola recognises that the country should diversify its economy and become less dependent on oil production. This is where the greatest opportunities lie for us as funders – the SME sector can make a major contribution to the diversification of the economy. In addition to the various benefits, it will be helpful for us to have a partner on the ground in Angola who has local knowledge and can provide us with insights, for instance, about a business located in the country that we are considering doing business with”, Nwosu says.

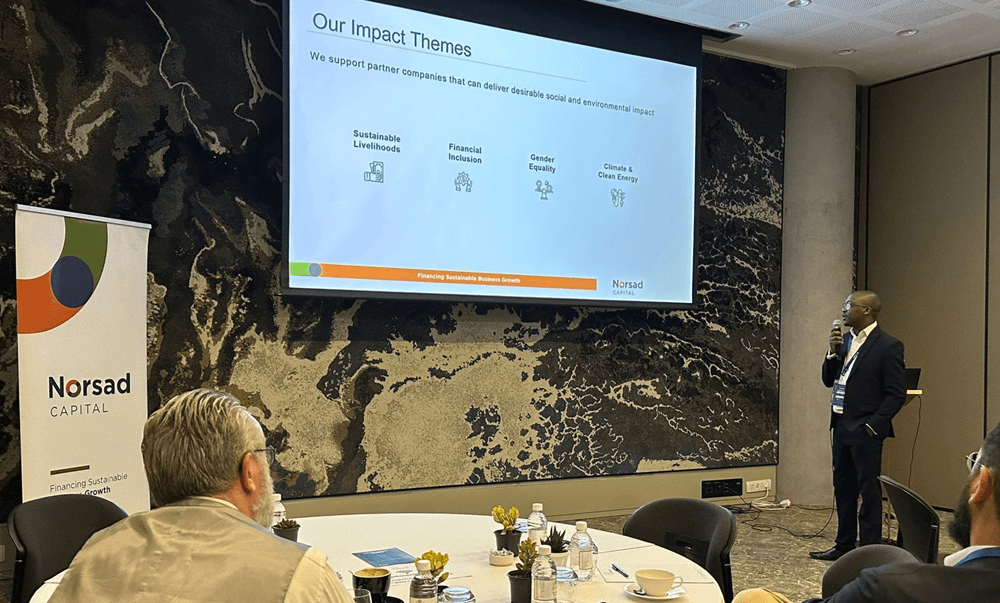

Identifying itself as an impact investor with a particular focus on the United Nations Sustainable Development Goals (SDGs), Norsad Capital aims to be a thematic impact investor that selects investments which clearly contribute to solving social and environmental challenges. This objective aligns with the overarching aim of the BDA: to contribute to the improvement of the quality of life of Angolans. Many of the sectors that are of importance to Norsad Capital are equally significant for the BDA, such as contributing to growth of the agriculture, livestock, manufacturing and other productive sectors, including the expansion of the renewable energy sector through solar and hydroelectric initiatives, improving logistics and transport infrastructure, and the pressing need for financial inclusion.

All in all, this partnership augurs well for the future of the economy of Angola. Likely to make more capital available to growth-stage businesses in the country, this relationship will promote economic growth in the region.