D I V E R S I F I E D I N V E S T I N G

Investment Portfolio

Norsad has invested in more than 170 companies in various sectors and countries in Africa. We seek diversified opportunities towards our portfolio construction and target investments that generate attractive returns and create positive social impact. Our current diversified investment portfolio comprises over 30 companies.

Sectors

Our sectoral focus, which is in alignment with our thematic areas, aims to achieve positive economic, social, and environmental impact. These high-impact sectors are key to unlocking financial inclusion, small and medium-sized enterprises (SMEs) development and growth, job creation, infrastructure development and climate change.

We can lend to businesses in a diverse range of industries if there is a good impact case that aligns with the Sustainable Development Goals (SDGs), and the businesses are not prohibited in the Norsad Exclusion List.

Our emphasis and focus are themed as follows:

Case Studies

S U S T A I N A B L E

Select Investments

Sector: Finance

Year: 2021

Value: ZAR 150 million

Sector: Finance

Year: 2023

Value: ZAR 150 million

Sector: Finance

Year: 2023

Value: ZAR 150 million

Sector: Consumer Staples

Year: 2022

Value: USD 7.5 million

Sector: Healthcare

Year: 2022

Value: ZAR 100 million

Sector: FinTech

Year: 2021

Value: USD 10 million

Sector: Consumer Staples

Year: 2023

Value: USD 10 million

Sector: Finance

Year: 2023

Value: USD 10 million

Sector: Finance

Year: 2022

Value: USD 10 million

Our Offering

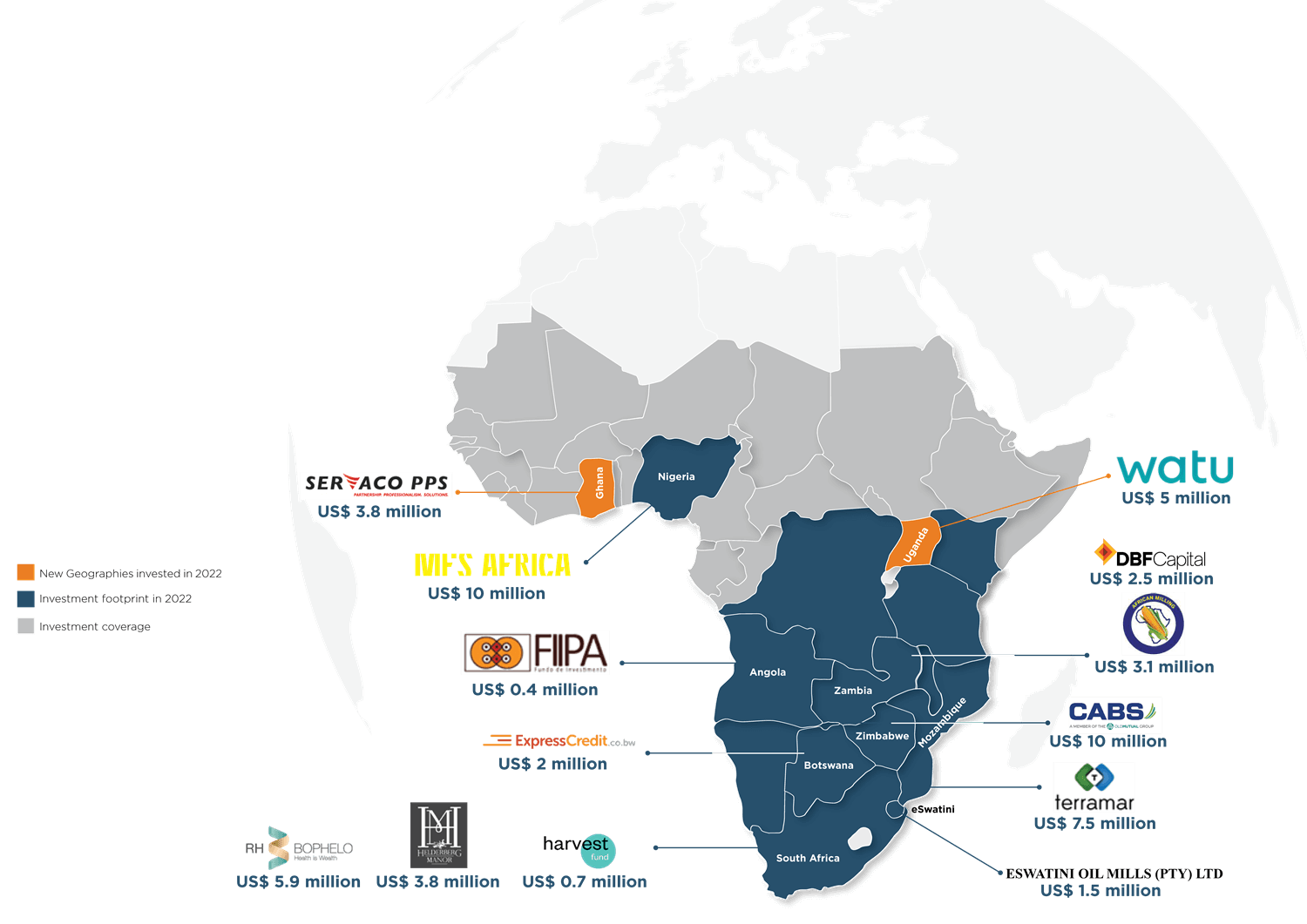

As part of our strategy, we continue to expand our footprint outside of the Southern African Development Community (SADC) region by investing in new geographies in Sub-Saharan Africa. Some select investments depicted in the map below: