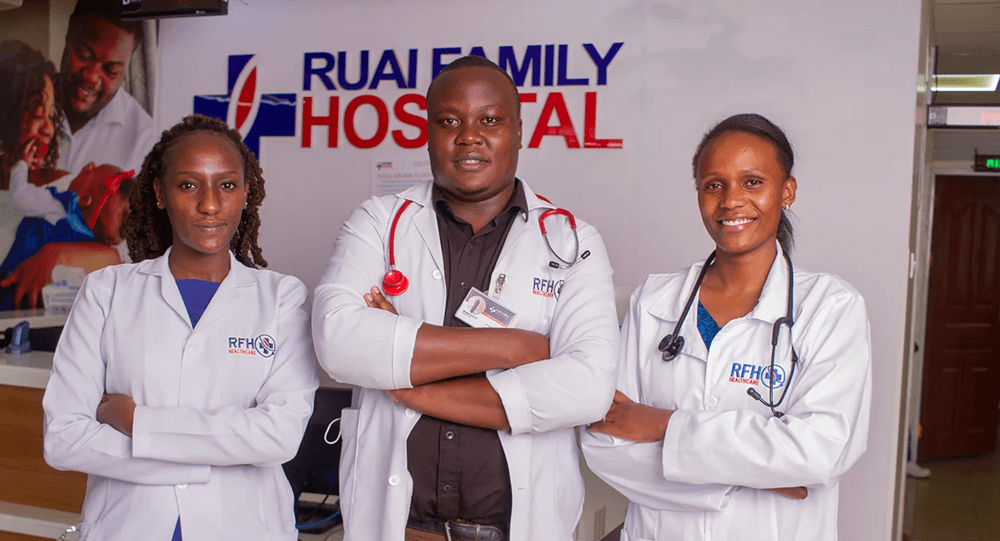

Press Release: Nairobi’s Ruai Family Hospital receives investment to help its fight against cancer

Norsad Capital cash injection set to improve oncology facilities for Nairobi’s lower and middle income communities

[Nairobi] 03 August 2023 – Norsad Capital, an impact investor and private creditor provider, has structured a facility to help Ruai Family Hospital (under the transaction advice of Noblestride Capital) improve access to affordable oncology healthcare for the lower and middle-income residents of Nairobi.

Kenya faces enormous healthcare challenges, specifically in populated areas of Nairobi where there are limited or no full-service healthcare providers. Cancer ranks as the third highest cause of death and the second most prevalent noncommunicable disease following cardiovascular diseases in Kenya. And, according to RFH, the occurrence of cancer is on the rise with reported figures of 47,887 new cases in 2018 and 42,116 new cases in 2020.

“The growing demand for affordable cancer diagnosis and treatment and the overflow of public hospitals, due to the lack of critical equipment, has prompted us to deliver this service to the Kenyan populace,” says Dr. Maxwel Okoth, Founder and Group Managing Director at RFH.

“Our primary objective is to ensure accessibility to the best medical practices and cutting-edge technological advancements, all delivered at affordable prices, to serve the needs of patients. Norsad’s investment will enable us to complete the construction of the oncology centre which will provide access to high-quality oncology treatment and care to cancer patients across Africa,” he adds.

Moreover, the cash injection aims to create significant job opportunities for the local community throughout the construction and operation of RFH’s the oncology centre. Local businesses will also benefit financially from the project as materials will be sourced from within the community. Overall, the project will provide economic benefits for the local population, thus stimulating economic activity in Nairobi.

“With Norsad’s strategy of diversifying into Sub-Saharan Africa, we are thrilled to have the opportunity to fund the growth strategy of RFH. The funding provided will play a crucial role in helping RFH complete its oncology centre which will offer comprehensive care and diagnostic services such as PET Scans, linear accelerator scans, MRI Machines, CATHLAB, Mammograms and others,” says Alice Zulu, Investment Director at Norsad Capital.

The investment supports Norsad’s commitment to expanding soft and social infrastructure, which aims to provide greater healthcare access to underserved communities. Moreover, the project aligns with the fundamental human rights of access to good equitable healthcare and well-being targeting the United Nations Sustainable Development Goals (SDGs) 3 (good health and wellbeing) and 10 (reduced inequalities).

“We recognise the importance of access to healthcare and its alignment with our aspiration of building a better Africa,” continues Zulu, adding that a strong healthcare system not only supports sustainable livelihoods but also enhances the overall quality of life for the population.

With origins dating back to 2011, RFH Healthcare emerged as a modest venture, having its roots in a one-bedroom apartment. Today it stands as a true leader in championing female empowerment; fulfilling the 2X Challenge’s investment criteria on leadership (with female board) representation, employment and consumption as RFHprovides access to maternity wards, gynaecologists, obstetricians, and other specialised services for women.

-ENDS-

About Norsad Capital

Norsad Capital is an impact investor providing tailor made debt solutions to mid-market growth companies in Sub-Saharan Africa. With a track record spanning over 33 years, Norsad Capital has invested over USD 700 million in more than 170 companies across the continent.

For more information: https://www.norsadcapital.com

About Ruai Family Hospital

Ruai Family Hospital Limited (RFH) is a Kenyan registered hospital chain of nine healthcare facilities founded in 2012 operating within Nairobi, Kiambu, and Machakos counties in Kenya. The hospital was first focused on maternal and child care. It has since expanded its offering to include primary outpatient care, specialists’ consultation, surgical clinics, renal, home-based care, critical care, imaging, sub-specialized care, among others.

Driven by innovation and excellence, the company has been awarded in the past by among others, Quality Healthcare Kenya Awards for Baraka Card – a healthcare financing platform created by the hospital to increase accessibility of their services.

For more information: https://rfhhealthcare.co.ke/

About Noblestride Capital

Noblestride Capital is a transactions advisory firm supporting mid-tier corporates in fundraising and M&A. The firm’s main services include debt capital raising, structuring equity deals, financial modeling, valuations, PE advisory and other corporate finance services. The company is registered by the Institute of Certified Investment and Financial Analysts (ICIFA) to engage in the practice of investment and financial analysis, perform investment advisory services and investment transactions, or engage in the practice of offering any services prescribed under the provisions of the Investment and Financial Analyst Act, No. 13 of 2015.

For more information: http://www.noblestride.co.ke